Worried about increases to property tax and homeowners insurance in Wake County, NC?

Wake County Taxes

Every 4 years (used to be 8), the county revalues properties, and 2024 came with just that! Happy New Year you could say. Many were alarmed by the assessment notice they received with those appreciating home values coming with a surprise of a 51% increase. DO NOT PANIC! The revaluation is normal and there is a formula for what your new tax rate will be. as well as a budget for taxes that the Board of Commissioners is held to. This will be a revenue-neutral increase. In short, your taxes are NOT going to double!

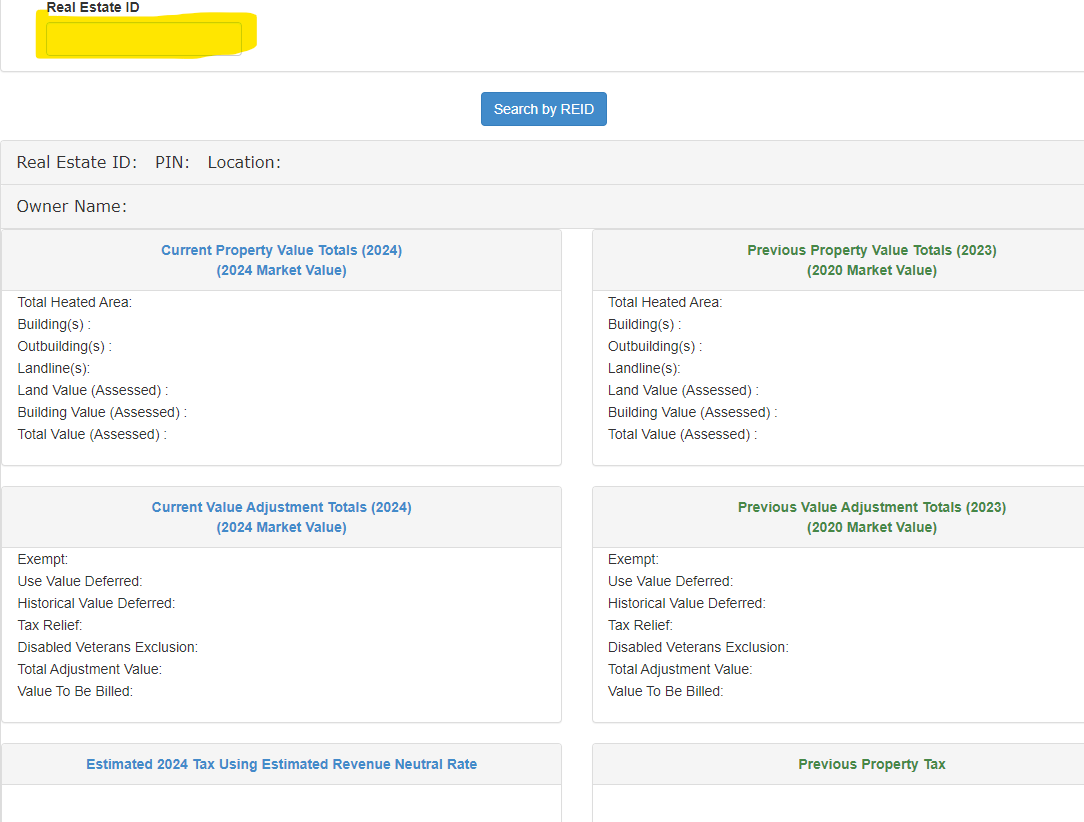

Here is the link to the Wake County Tax Administration website that includes an overview of this as well as a calculator that provides an estimate of what the new taxes specific to your property should be.

Wake County Revaluation General Info

Revenue-Neutral Calculator

Enter your Real Estate ID found on your Property Tax Card

* Note that when you run this estimator this will only show Wake County taxes, NOT the city you are located in so your TOTAL tax bill will be higher because you have to include your city taxes.

Insurance

A 42% increase was proposed and was denied by the NC Insurance Commissioner. The last proposal in 2021 resulted in a 7.9% increase. You should expect an increase to come but at a more reasonable percentage.